Arroyo Investment Group

A Higher Standard of Wealth Management

Not all financial advisors are accountable to you, but we are. Learn how our GIPS© compliant investment management plus comprehensive financial planning provides a better way to build and protect your wealth.

Learn More

Fully Accountable to You

You pay your financial advisor to manage your money. Don’t you deserve to know how good they are at it?

Sounds simple, but the vast majority of advisors don’t share their long-term investment returns. Instead, most invest your money passively and your portfolio tends to rise and fall with the general market.

At Arroyo, we don’t agree with this approach. You deserve investment management that keeps your money working for you through all markets and economic cycles. When you’re paying a professional, you shouldn’t have to “ride it out” or wait years for your savings to recover. And you need to be kept fully informed. That’s why at Arroyo, we provide GIPS® compliant reporting. This way you always know how good a job we are doing for you.

Did You Know?

Only about 1,700* firms in the entire world provide

GIPS® compliant investment reporting.

The vast majority of these firms work with corporations and institutions, who demand this information, not individuals.

At Arroyo, we believe we should be held accountable, so we voluntarily provide GIPS® compliant investment reporting.

*per CFA Institute, as of Oct. 2023, https://www.gipsstandards.org/

Arroyo Insights

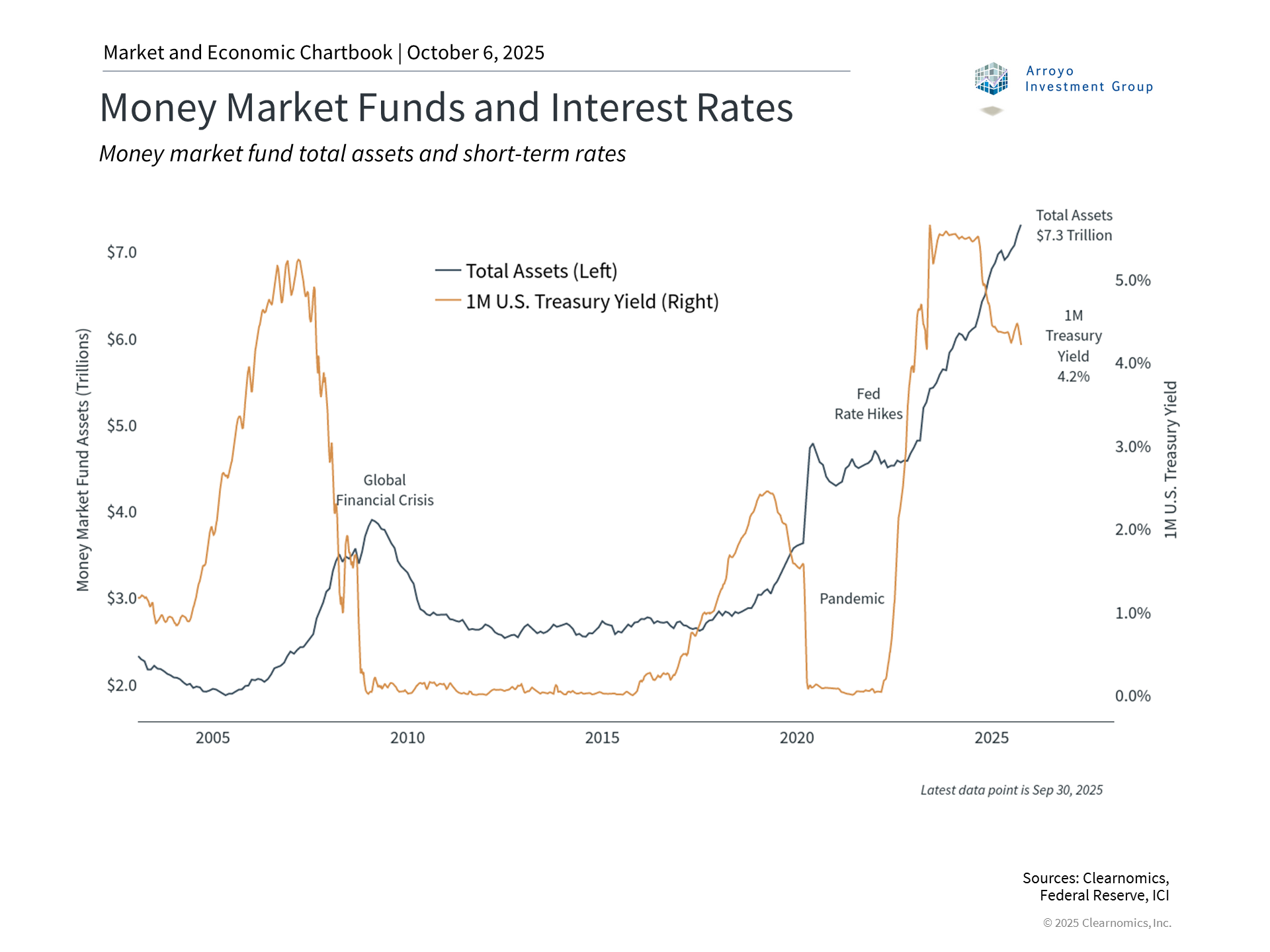

Are Investors Holding Too Much Cash?

For long-term investors, a growing challenge today is how to manage cash as short-term interest rates fall. What appears safe actually comes with real costs.

Should You Set Up a Trust? 5 Questions To Ask First

You've heard about trusts. But is one right for your family? Learn about 5 important questions to ask before you decide to set up a trust.

How to Navigate Fears of a Market Bubble

As markets reach new highs and artificial intelligence stocks continue to rally, some investors are asking "are we in a bubble?